Among a raft of other challenges, logistics is under increasing pressure to decarbonise. Whilst an essential supply chain goal, it’s undoubtedly difficult in a volatile trading environment to balance decarbonisation with cost and service reliability.

The UK government's new Maritime Decarbonisation Strategy, released at the end of March 2025 has given logistics managers yet more legislation and goals to wrap their heads around.

At 99-pages long it’s difficult to understand by itself, and that’s before you look at the other overlapping strategies from the IMO and EU.

This article will outline the key takeaways and impacts for shippers from the UK's new Maritime Decarbonisation Strategy. Then it will explain how it compares to the International Maritime Organization (IMO) and the EU strategies, to help you understand all the factors at play.

The UK Maritime Decarbonisation Strategy 2025: Key Takeaways

Put simply, the UK Government’s strategy sets out a path for reducing greenhouse gas (GHG) emissions from maritime transport. It sets slightly more ambitious targets domestically than many other international strategies.

The top-level emissions targets:

- 30% reduction in lifecycle GHG emissions from shipping by 2030 (relative to 2008 levels)

- 80% reduction by 2040

- Net-zero emissions by 2050

These targets are more ambitious than current global IMO targets as outlined in the 2023 Strategy on Reduction of GHG Emissions from Ships. They place pressure on carriers operating in and out of UK ports to decarbonise more quickly.

Maritime Transportation will be brought under UK ETS, but only domestically

The UK Emissions Trading Scheme (ETS) is a system where producers of CO2 emissions in certain industries must pay for credits to emit beyond a certain limit.

From 2026, the UK Emissions Trading Scheme will be extended to include domestic maritime emissions. It will apply to vessels over 5,000 gross tonnage operating between UK ports or to UK offshore installations. So, operators of these vessels will have to buy credits. Costs which will likely be passed to shippers.

However, as it stands there is no mention of bringing international maritime transportation under the UK ETS scheme, like is currently in place for the EU. For shippers into the European Union, EU ETS surcharges are due on 50% of the vessel emissions on voyages starting or ending outside the bloc. A cost the carriers have already been passing onto shippers.

However, the UK’s strategy only mentions domestic transportation. Our understanding is that international shippers sending or receiving goods from other nations won’t be affected, unless the scheme is widened.

But, it must be said UK shippers have often been forced to pay EU ETS surcharges, when vessels have been docking at EU ports as well as UK ones (which is often the case). You can read more on the EU ETS scheme in our article here.

This is not to say the UK ETS won’t be widened to include international transportation. But currently it’s not mentioned in the strategy.

Fuel regulations

The UK intends to introduce domestic fuel regulations to support the uptake of zero and near-zero GHG fuels. Smaller vessels are being more keenly targeted with these regulations. A formal consultation will take place in 2026, and regulations will be introduced pending the results of that. The long-term aim is to drive fleet renewal or retrofits.

Emissions at berth

The government is actively considering how to reduce emissions while vessels are in port. It’s reported in the strategy that nearly half UK domestic maritime emissions come from vessels which aren’t moving.

Shore power, enforced idling restrictions, and differential port fees are all on the table. Its hoped any changes would force a change in operational behaviour from carriers serving UK ports.

Development of green shipping corridors

The strategy promises to have one international shipping corridor in place by the end of 2027/28, and three domestic ones established by the same timeframe. A green shipping corridor is one where there is infrastructure in place for a vessel to operate completely emission free along the route.

For all the legislation from the strategy, in very short-form, you can find them here and scroll to page 9.

How the UK Strategy Compares to IMO and EU Policies

To understand the full picture, it’s important to look beyond the UK. The International Maritime Organization (IMO) and European Union (EU) are both pursuing maritime decarbonisation through their own strategies.

The UK strategy talks extensively about driving ambitious targets from the IMO’s GHG Emissions Strategy, which applies globally.

The IMO GHG Emissions Strategy

The IMO adopted its revised greenhouse gas strategy in July 2023, targeting:

- 20% GHG reduction by 2030 (aspirational 30%)

- 70-80% by 2040

- Net-zero around 2050

This overall strategy is followed by regular meetings of IMO members to agree more specific regulations to achieve the above goals.

In April 2025, the IMO reached agreement on new emissions limits and a global carbon pricing mechanism. To understand the details of the agreement in granular detail, see an article from Clear Blue Markets here.

While these measures show progress, the IMO’s framework lacks a detailed plan for enforcement and relies on individual member states for implementation. The IMO regulation is not legally binding unless adopted and enforced by national governments. It sets the global direction, but not the immediate compliance rules.

Many high-ambition regions (UK, EU, parts of Asia) are moving faster, and shipping lines will be forced to comply with their local rules before IMO timelines kick in.

The EU Environmental Regulation

The EU is taking a firmer and faster stance. Key measures include:

- EU ETS where Maritime emissions have been included since 2024. It applies to intra-EU voyages and 50% of extra-EU voyage emissions. You can read much more about this piece of legislation here.

- FuelEU Maritime Regulation came into effect at the start of 2025. It requires ships to reduce the GHG intensity of the energy they use, starting at a low level, but hitting an 80% reduction target by 2050. To understand the initiative more, click here.

Again, these are binding laws, enforced by the European Commission and individual member states, with penalties for non-compliance. Shipping lines trading through Europe are already pricing this in and as mentioned earlier, passing these costs to shippers in many cases.

Full Comparison Table: UK vs IMO vs EU

|

Policy Area |

IMO |

UK (2025 Strategy) |

EU (Fit for 55 / ETS) |

|

Emissions Targets |

20% by 2030, 70-80% by 2040, net zero by ~2050 |

30% by 2030, 80% by 2040, net zero by 2050 |

55% by 2030 (economy-wide), climate neutrality by 2050 |

|

Carbon Pricing |

Global levy from 2027 ($380/tonne above baseline) |

UK ETS applies to domestic shipping from 2026 |

EU ETS includes maritime from 2024 |

|

Fuel Standards |

Global fuel standard in development |

Domestic regulations due post-2026 consultation |

FuelEU Maritime regulation from 2025 |

|

Legal Status |

Non-binding unless adopted nationally |

Legally binding within the UK |

Legally binding across all EU states |

|

Scope |

Global; all international voyages |

Domestic shipping and vessels calling at UK ports |

Intra-EU and 50% of voyages entering/leaving the EU |

|

At-Berth Emissions |

Not regulated |

Under consultation (shore power, idling restrictions) |

Varies by port; some enforce shore power already |

|

Cost Impact on Shippers |

Low in short term; rising post-2027 |

Moderate from 2026; will escalate with stricter ETS rules |

Immediate and rising costs; surcharges already appearing |

What this means for shippers

The maritime industries transition to lower emission is going to gather pace over the coming years and shippers need to be prepared to shoulder some of the costs associated with that transition.

For shippers in the UK or EU, this is going to be felt even more pertinently, as both are looking to lead the world in decarbonisation. Consequently, we can predict the following impacts on your logistical movements involving maritime transport:

- Additional costs, in the form of carbon surcharges or higher BAFs (Bunker Adjustment Factors). We have already seen EU ETS surcharges being added to shipping quotes, expect this to only amplify.

- Routing changes to comply with emissions regulation. Shipping lines are likely to tweak their routing options (as best they can) to dock where regulation suits their assets best.

- Increasingly port infrastructure will drive the calling choices of major carriers. We could see availability of sustainable fuels play an increasingly important role in where carriers dock.

- This is not just a matter for the carriers. Your supply chain’s emissions will also come under more scrutiny. Corporate sustainability reporting (CSRD in the EU, TCFD in the UK) will increasingly expect emissions data from Scope 3 activities for businesses in all industries and that includes freight transportation.

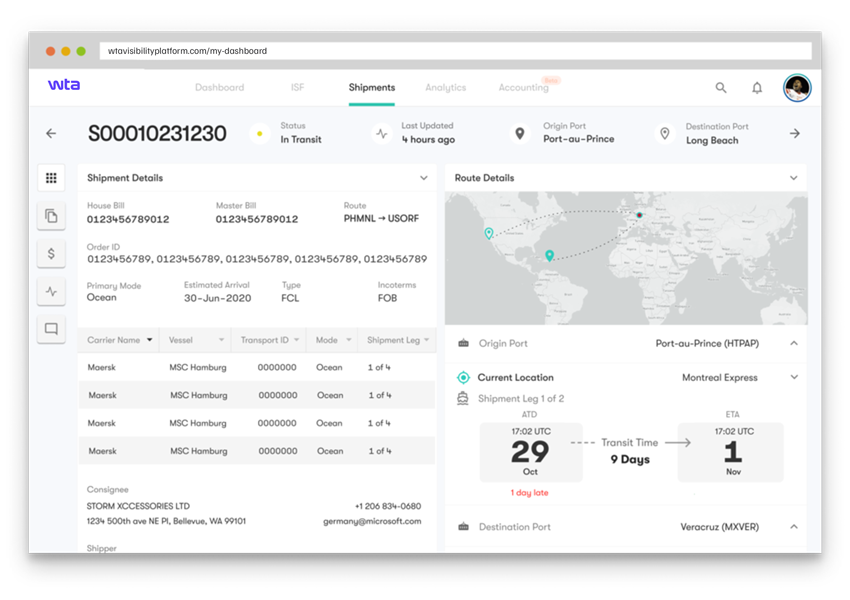

The WTA Platform.

Assess your exposure to environmental regulation, using our CO2 emissions tracker within the WTA Platform.

Our tracking delivers complete clarity on the environmental impact of your logistical emissions, so you can work to reduce your footprint. But that's just one of the countless data insights delivered by our platform.

The IMO, UK and EU are working towards the same long-term goal: net-zero maritime emissions by 2050. But while the IMO struggles to grapple with very different domestic agendas from nations across the world, the UK and EU are more united and more ambitious.

For businesses in the UK and EU, the domestic strategies and legislation related to maritime emissions are the ones to focus on. They are the legally binding pieces of legislation and are typically more ambitious than IMO targets.

What’s certain is that this move towards carbon-free shipping will only amplify over the coming years. Driven by consumer expectations and environmental necessity. Shippers must stay ahead of the news to avoid being compromised by new legislation. One easy step to take is by starting to track your logistical emissions with the CO2 tracker within the WTA Platform. Reach out for a demo below.