The Chancellor Jeremy Hunt has delivered his Spring Budget for 2024. In it, the reduction of National Insurance contributions for workers from 10% to 8% from April 2024 has stolen the lead headlines. It was also delivered alongside an improving picture for UK economic growth and inflation.

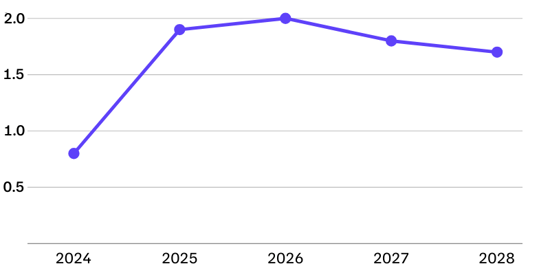

In the latest forecast by the Office for Budget Responsibility, GDP growth is expected to return to nearly 2% per year from 2025, whilst inflation is forecast to be under the Bank of England's 2% target by June 2024.

However, there’s far more to unpick from this statement for businesses.

We have dug a little deeper to find the announcements more pertinent to business leaders across the UK. While the headlines reflect the changes for individuals and public spending, the policy announcements for businesses could have significant consequences for your operations and growth strategy.

Here we explore the key takeaways for businesses from the 2024 Spring Budget.

UK GDP Growth Forecast (%)

Source: OBR

Source: OBR

Key headlines for businesses.

Fuel Duty Freeze.

In a move widely anticipated, the Chancellor announced a freeze of fuel duty for another year, maintaining the 53p per litre rate. It means the 5p rate cut, which was introduced in March 2022 in response to surging oil prices, remains in place.

It’s a move which will benefit businesses in all commodity sectors who rely on haulage, but is a significant relief to the road freight sector itself, where fuel represents roughly 1/3rd of operational costs.

“Logistics powers every part of the economy, and an increase in operating costs at this time caused by the reversal of the fuel duty cut could have caused disastrous inflationary pressure on the economy. Maintaining the fuel duty cut will provide logistics businesses with more certainty as they drive the transition to a greener economy.”

Logistics UK

Both Logistics UK and the Road Haulage Association have welcomed this decision, emphasising the critical role of the logistics sector in the broader economy and the need for support in the transition to greener alternatives. Over 450 UK road haulage companies went bust in the last 12 months, reflecting the troubling times for the sector.

However, calls from the road freight industry to suspend Vehicle Excise Duty on HGVs and the HGV Levy, went unanswered. The HGV levy is a charge based on the emissions and weight of vehicles over 12,000kg. It returned on August 1st 2023, after a 3 year suspension from 2020. However, despite the cost pressures in the sector, there was no announcement of changes to the policy from Jeremy Hunt.

Expansion of Full Expensing Scheme.

Businesses will benefit from the expansion of full expensing, which will now include leased machinery and vehicles. This policy, originally effective from April 2023, enables companies to claim 100% capital allowances on qualifying investments.

By allowing companies to write off the cost of these investments immediately, the scheme reduces their tax bills, meaning greater affordability of assets. For the transport sector, qualifying purchases now include leasing vehicles, which is particularly beneficial for smaller road haulage and final mile delivery operators.

“Having listened to calls from the CBI, Make UK and the BCC, we’ll shortly publish draft legislation for full expensing to apply to leased assets. A change I plan to bring in as soon as it’s affordable.”

Jeremy Hunt, Chancellor of the Exchequer

“The extension of full expensing to leased assets will benefit smaller companies in particular, and we would urge draft legislation to be brought forward as soon as possible to that this measure can be made permanent at the earliest opportunity.”

Stephen Philson CBE, CEO, Make UK

Alcohol Duty Freeze.

The freeze on alcohol duty has been extended until February 2025. A move to help the hospitality sector, including craft breweries, spirit distilleries, distributors and the 38,000 pubs which have been particularly hard-hit by the cost of living crisis.

It comes after major changes for the way alcohol duty is taxed came into force in August 2023. However, following a freeze to alcohol duty in the 2023 Autumn Statement, many in the sector were expecting to be hit with an inflation-level increase this time around. However, that has not proven to be the case. It's hoped this policy will help mitigate the rising cost of alcoholic beverages, providing some respite for both venues and drink producers amid these rising cost pressures.

Increase in VAT Registration Threshold.

The Chancellor raised the VAT registration threshold from £85,000 to £90,000, marking the first increase in seven years. This adjustment aims to enhance the competitiveness of smaller businesses by allowing them to generate more revenue before needing to register for VAT.

Adjustments to Air Passenger Duty Rates.

The 2025-26 rates for Air Passenger Duty will see an increase in line with the Retail Price Index (RPI). Rates for ‘non-economy’ passengers will face a further increase, reflecting an effort to balance fiscal responsibilities with the need for sustainable travel.

Extended Tax Reliefs for Freeports and Investment Zones.

The window for claiming tax relief at Freeport sites is being extended to September 2034 for Scotland and Wales, whilst remaining until September 2031 in England.

Freeports are specific regions, typically surrounding a key logistical hub, that can offer unique incentives to encourage businesses to invest there. These incentives include customs simplifications and tax breaks.

More information can be found on the location of freeport sites and how businesses can benefit from investment on the government website here.

Meanwhile, Investment Zones will be extended from five to ten years in Scotland and Wales, matching the extension announced for England at Autumn Statement 2023.

Chancellor Jeremy Hunt's March Budget of 2024 presented a series of targeted policy announcements aimed at supporting businesses across various sectors. The underlying themes were undoubtedly driving growth, whilst supporting working families and key industries.

While the National Insurance cut may have dominated headlines, the measures important tor businesses, from fuel duty freezes to extended tax reliefs, reflect a Chancellor looking to foster economic stability and growth.