On Friday 15th December 2023, the world’s 2nd largest container shipping line Maersk announced that all vessels had been advised not to pass through the Bab-al Mandab strait to the south of the Red Sea. It came after a missile attack from the Houthi rebel group, which narrowly missed the Maersk Gibraltar vessel.

The Red Sea and wider Middle East region

The Red Sea and wider Middle East region

“Following the near-miss incident involving Maersk Gibraltar yesterday and yet another attack on a container vessel today, we have instructed all Maersk vessels in the area bound to pass through the Bab al-Mandab Strait to pause their journey until further notice.”

Maersk statement, Friday 15th December 2023

A string of alarming attacks on commercial shipping in the region began with the illegal seizure of the Galaxy Leader cargo ship and her crew. Who remain as hostages to this day.

It was the beginning of Red Sea Diversion.

An event which has dominated the news and decision making for supply chain leaders throughout 2024. Roughly 30% of containerised trade passes through the Red Sea in normal circumstances.

Since that moment in mid-December, vessels on major East to West trading routes have almost all been completely avoiding the area. Instead taking a roughly 3000 nautical mile diversion around the Cape of Good Hope in South Africa.

To see a timeline of events over the last year, see our latest information and advice on the Red Sea article.

So, what lessons can supply chain and logistics managers learn from the Red Sea diversion of the last year?

The Red Sea diversion will remain in place in 2025

At the time of implementation, the industry had hoped it would be a short term measure, and that Operation Prosperity Guardian would provide adequate safety for ships. However, as the weeks unfolded, it became clear it was a diversion for the long term.

Unfortunately, as we arrive at the ‘1 year on’ moment, there are no indications the diversion will end anytime soon.

Whilst attacks on some of the vessels which irresponsibly attempt to navigate the waterway are with reduced frequency, they are still occurring. It can be concluded that the major shipping lines, who dominate the deep-sea trades, will not return until the threat of attacks is completely removed.

Some analysts have even questioned if that will ever be the case.

But it must be said, it’s not in the financial interest of the shipping lines to begin using the Red Sea again. The carriers are on track for their most profitable year outside of the covid era. Profits in Q3 2024 were 856% up on 12 months previously. This is largely being attributed to the Red Sea diversion placing a severe strain on capacity during the peak season.

Combining this factor with the continued risk of transiting the waterway, there is no prospect of a return in the near term.

Container shipping needs more resilience to deal with shocks - and it might be getting it

One takeaway from the Red Sea diversion, and the Covid-19 pandemic supply chain crunch previously, is that container shipping badly needs more resilience.

Containerised Freight Index. Source: Trading Economics

It’s simply unsustainable for shippers to be victim to these kinds of rate surges with this kind of regularity. In an increasingly volatile world, with geopolitical pressures and environmental concerns, carriers need to work on creating a more stable rate market.

Now, it can be reasonably argued that the two events mentioned are so disruptive, no amount of resilience could have prepared the industry. But that doesn’t mean sea freight carriers can absolve themselves of blame.

In positive news, increased resilience may be arriving.

Much to the surprise of many industry analysts, the shipping lines have engaged in an aggressive vessel ordering programme in 2024. 284 new vessels have been ordered up to the 1st November in 2024, according to Alphaliner data, totalling 3,427,268 teu. Over 2 million of which came in Q3. A record quarter for new containership orders.

| October | 2024 to Nov 1st | |

| New container vessel deliveries | +213,543 teu | 2,561,363 teu |

| Container vessel scrapings | +7,746 teu | 88,367 teu |

| New container vessel orders | +419,880 teu | 3,427,268 teu |

Source: WTA's Freight Rate Forecast

All these orders are set to take the total containership fleet to almost 35 million teu by the end of 2026.

This kind of appetite for new ships, on top of the 2.5 million teu delivered to November of 2024, is hoped to create some resilience in the market. So, when disruption strikes, there is spare capacity available to respond without aggressive rate increases.

Shippers should prioritise their own supply chain resilience

Another lesson from recent years, is the increased emphasis that shippers should place on their own supply chain resilience. Steps can be taken to reduce exposure to huge swings in freight rate.

Using a supply chain visibility tool is one method. With full transparency on location, cost and timings, shippers can make optimisations to their logistics. It becomes easy to identify if a certain carrier, port or route is leading to bloated costs.

Access to this data makes identifying these inefficiencies a breeze, leading to cost savings and reduced exposure to spot rate changes.

“The idea that visibility tools are about seeing where a shippers' containers are on a map is a mostly false impression. The data they give shippers access to is where the benefit really lies. They give total transparency on all vital data points related to logistics, meaning people can identify problems and make cost saving optimisations.”

Anthony Bour, Director of IT, WTA Group

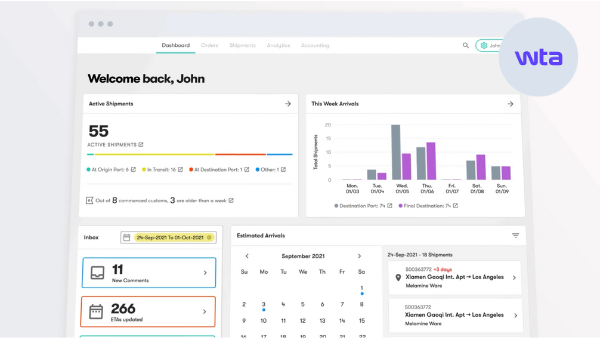

The WTA Platform

All WTA customers receive access to the WTA Platform, containing all the vital cost and timing data related to a supply chain.

Quickly find your shipments, with real-time status. Manage orders and invoices. Analyse and optimise your supply chain.

Supplier diversification is another strategy. By opting to source goods from a range of locations, businesses mitigate the risks of a single suppler. If rates from of a particular location are too high.

We have written a detailed article on the benefits and drawbacks of supplier diversification here. It might be a valuable option for your business.

Complete detailed scenario planning for your supply chain

Scenario planning is the act of anticipating and preparing for potential future disruptive events. It involves creating and evaluating a range of plausible scenarios based on key uncertainties or variables that could impact the logistics industry.

This means identifying vulnerabilities which could threaten the smooth operations on a trade lane. By analysing these scenarios, businesses can identify risks, opportunities, and strategies to navigate potential future challenges effectively.

Top risks to supply chains in 2025 include:

- Geopolitical relationship breakdown.

- Potential vulnerabilities include tensions over Taiwan and tariffs between USA and other nations, most notably China.

- Extreme weather events.

- Poor performing economies and instability.

- Many key European markets are struggling to find growth.

- Many key European markets are struggling to find growth.

- Cyber-attacks.

- Incoming environmental regulation.

By contingency planning for these events, and any others you deem likely, you are better prepared. We have much more detail on how shippers can mitigate supply chain risk here.

2024 delivered a year for shipping which went completely against predictions. But within the chaos, there are lessons for all stakeholders in international trade. Lessons on how we can adapt supply chains to cope with a continued Red Sea diversion in 2025, and how we can mitigate against future disruptions. Whatever form they take.

To help guide your supply chain, subscribe to the WTA Freight Rate Forecast. This monthly newsletter uses industry data to forecast the trajectory over the coming weeks, guiding your decision making. Sign up now for free.