On Friday 7th July, the International Maritime Organisation (IMO) unveiled their 2023 Greenhouse Gas (GHG) Reduction Strategy. A revision of their initial GHG Reduction Strategy from 2018, the new report outlines the emission reducing targets the shipping industry is expected to meet over the next 30 years.

It's the product of a large meeting of the IMO's Marine Environment Protection Committee at their headquarters in London, which aims to bring together all 175 member states in pursuit of shared environmental goals.

The need to decarbonise shipping is clear for all to see. IMO studies suggest it contributes roughly 3% towards global emissions. If it was a country, it would be the 6th highest polluting country on the planet. More than Germany, the UK, Brazil or South Korea.

So let's look in detail at what this strategy actually means for shippers who are operating international supply chains and highlight what supply chain managers need to be aware of in the years ahead.

What has been announced in the 2023 GHG Reduction Strategy?

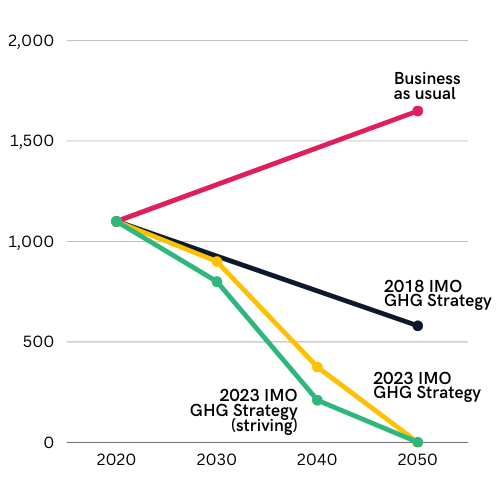

The headline announcement from the IMO's 2023 GHG Reduction Strategy is a commitment to reduce planet warming gases to net-zero, "by or around 2050". Now, this represents a sizable upscaling of the objectives laid out in the 2018 version of this document, which set the target of a 50% reduction by 2050.

Also included however are a couple of new interim targets:

- To reduce the total annual GHG emissions from international shipping by at least 20%, striving for 30%, by 2030, compared to 2008.

- To reduce the total annual GHG emissions from international shipping by at least 70%, striving for 80%, by 2040, compared to 2008.

The wording of both interim goals suggests disagreements between stakeholders on the speed of progress needed. "Striving for 30%" and "striving for 80%" by 2030 and 2040 respectively, would suggest some parties were unsuccessful in securing more aggressive targets. Critics would argue "striving for" makes that aspect of the goal meaningless.

Well-to-wake GHG emissions from shipping (Mt CO2e)

Source: The ICCT

Source: The ICCT

The announcement was met with protestors outside the London HQ, as critics argue the measures announced don't go far enough.

But what it clearly indicates is an scaling up of ambition from the International Maritime Organisation since 2018. Anyone working in international logistics would be wise to monitor developments and should factor incoming aggressive legislation into long-term strategic plans.

How does the IMO intend on reaching net-zero?

That is the big question, which we're afraid the IMO can't answer fully yet. The agreement this month has only highlighted the aims en-route to hitting net-zero. It doesn't include legally-binding legislation how to get there.

It highlights that by 2025, the committee will have agreed mid-term emission reducing measures. But for long term measures, we'll be waiting until 2030.

However, many of the short term measures unveiled already offer some insight into what shippers can expect to come. For example the legally binding Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII), both products of the 2018 GHG Strategy, entered into force in 2023.

The EEXI is a technical measure setting new minimum requirements for the energy efficiency of existing ships, and applies to all cargo and passenger vessels above 400 gross tonnage. The CII meanwhile grades the carbon efficiency of ships. Basically, how much carbon they release per tonne of cargo carried.

However, criticism of both has been that they aren't tough enough. In a lot of cases, slow steaming has been sufficient for shipping lines to meet the requirements. In many cases, not meeting them isn't punished sufficiently.

Although the measures are to be revised before 2026 and I think we can expect a significant dialling up of the rules.

For the medium and long term measures though, which we are yet to find out, the IMO is ensuring they are comprised of two criteria:

- Technical element: A standard which will regulate the introduction of less-polluting marine fuels.

- Economic element: A pricing mechanism to make less-polluting fuels more economically viable.

The IMO accepts "mid-term GHG reduction measures should effectively promote the energy transition of shipping and provide the world fleet a needed incentive", however there is no clarity on what these incentives will be.

"The adoption of the 2023 IMO Greenhouse Gas Strategy is a monumental development for IMO and opens a new chapter towards maritime decarbonization. At the same time, it is not the end goal, it is in many ways a starting point for the work that needs to intensify even more over the years and decades ahead of us."

IMO Secretary-General Kitack Lim

How will the 2023 IMO GHG Reduction Strategy impact shippers?

While the IMO's targets in this announcement are grand, it must be said there is no immediate direct impact that shippers need to be aware of.

But the direction of travel is clear. Businesses need to be building sustainability into their supply chain to stay on the right side of legislation in the years to come.

The shipping lines are clearly bracing for tougher emission legislation with orders for methanol-powered vessels (a cost-competitive propulsion method which can offer a significant emission reduction). 35 methanol-ready ships were added to order books in 2022, with plenty more orders this year. Only last week Maersk placed an order for 6 more, that follows an order of a dozen by CMA CGM and 9 from HMM in February.

Unfortunately, what shippers can expect is any cost implications of the legislation to come is unlikely to be swallowed by the shipping lines and will probably be built into their pricing structure.

Shippers would be wise to adopt sustainability planning of their own into their supply chains.

Scope 3 CO2 emissions (those which are indirectly released by a business as part of their supply chain) are estimated to make up more than 70% of a businesses emissions in many cases. Controlling and reducing scope 3 emissions is likely the most effective way of reducing product emissions and building sustainability into its selling point.

In many industries, customers are demanding sustainability in products too. While the IMO sets goals, interim goals and interim goals for the interim goals, real customers are increasingly demanding progress from businesses on CO2 emissions. Sustainability is driving buying decisions.

A wise step for any supply chain manager is bringing emissions targets into strategic planning and best way to achieve this is through supply chain data. Supply chain visibility tools which contain emission trackers are the most conclusive way to show progress on sustainability.

"Decarbonising a supply chain is likely the best way a business can go about building sustainability into a product, such is the extent of scope 3 emissions. Having access to the right data to quantify this is a vital step."

WTA UK Country Director, Gerry Power

WTA Group's brand new digital visibility platform has been designed so supply chain managers can monitor and optimise their logistics to meet sustainability and cost targets in the years to come. A built-in emissions tracker gives you all the data you need to make informed decarbonising decisions and see the impact of their implementation. Join the waiting list for an exclusive demo below.

The full IMO GHG Reduction Strategy can be read here.

Explore more of WTA Group's content on logistics sustainability here.