In 2023, it’s very easy to answer that question. Yes. China remains successfully positioned with a lucrative value proposition for shippers. Materials and manufacture for an unbeatable price, supported by world-leading infrastructure.

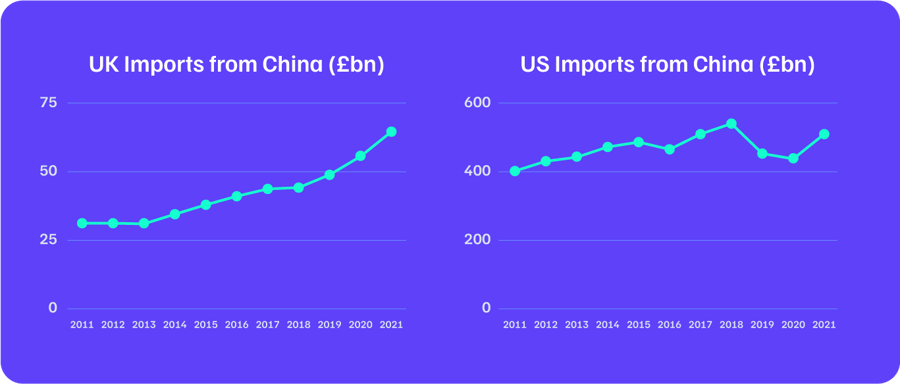

It’s a value proposition UK and US consumers are addicted to. The UK received £63.6bn in goods from China in 2021, for America the figure was $505.3bn. In both cases, the PRC is their biggest import partner, with trade volumes outstripping local competitors such as Germany and Mexico respectively.

“Roughly 75% of the quotes we provide to customers from the Asia region are from China, so that just highlights the pulling power that it still has.” Justin Hope, Associate Director – imports, WTA.

Yet, whether to relocate some or all their businesses imports away from China is a conversation which can be heard in boardrooms across the UK and USA. In some cases, firms are already beginning to move manufacture.

Tech giant Apple, arguably the most high-profile example, is planning to produce some of their iPhone 14s in India. A move which raised plenty of eyebrows on both sides of the Atlantic. It’s part of a wider aim of completing 25% of their manufacture in India. A sizeable increase on the 7-8% which happens there currently, mostly of older models. But why?

“Covid-19 really brought to light our over-dependence on one or two manufacturing areas” James Micklethwaite, Freight Account Manager, WTA.

The 2020 pandemic, geopolitical tensions, rising costs, and other emerging economies are just some of the driving factors behind this conversation. Possibly for the first time, supply chain diversification is a strategic priority for western businesses.

The China Plus One approach has risen from a flaky logistics industry buzz-phrase to a genuine long-term goal for many businesses. Some looking to relocate their supply chain entirely.

It’s against this private sector backdrop, that wta group has produced a new whitepaper and podcast, exploring other options in the Asia region and beyond, that businesses could explore for procurement. They also take a detailed look at the pros and cons of importing from China in 2023 and provide insight choosing a new market for your imports.

The whitepaper can be downloaded from the link below. Alternatively, you can listen to the podcast by clicking the thumbnail or read the full transcript from the podcast at the bottom of this article.

Is China still the world's import hub? A WTA Freight Club podcast available to listen here.

Is China still the world's import hub? - podcast transcript

Scott Wallis

Today, on Freight Club, we're discussing imports. Specifically, the landscape of importing from China in 2023. Whether to explore other options is a conversation that many business leaders, both in the UK and the USA, are having for a whole host of reasons, some have even begun to diversify their supply chains. Apple are a recent high-profile example. They're looking to move 25 percent of their manufacturing to India and away from China. So, to help understand the reasons why we're hearing more examples of this and explore some of the other options available to businesses, joining me today, we have Justin Hope, our Associate Director of Imports at WTA Group. With over 20 years in the industry, there isn't much Justin doesn't know about logistics, and with a reputation amongst staff and clients of straight-talking honesty, I reckon he's the perfect person to give us an accurate assessment of the landscape.

Scott Wallis

Good morning, Justin, and welcome to the podcast. Now I've just said in the intro there that you have a reputation for straight-talking honesty. Is that something that you would agree with?

Justin Hope

Yeah. I'd like to pride myself on that, I'd say. I try and give the warts and all outline of what's going on, what I think will happen and so on. I try not to promise things that we can't do to give a pretty picture if it's not. So, yeah, I guess that's a fair comment.

Scott Wallis

In that case, I would say the perfect podcast guest, I would say. No hot air to be found here. So, we're discussing importing from China and the Asia region in general on the podcast today. I suppose the first place to start really is just trying to understand why is it now that that we're having this conversation around relocating imports? Why has that particular avenue of conversation, do you think, come to the fore over the last year or two?

Justin Hope

It's certainly something that's been discussed in the past. I mean, I've been speaking with customers going back probably 10 years who have been considering it, for some of the reasons we're going to come on to. But as you say, it's probably become more prevalent over the last couple of years, and the obvious reason is what happened with the Covid disruption. I think, people sort of sat up and took notice of what carnage that caused with regard to rates, the space, the appalling service that people were getting from the shipping lines who couldn't cope the congestion. I mean, rates got ridiculous, we were up to about 20,000 dollars for a 40-foot, whereas it probably had been sitting at about 2,000 dollars before this all happened.

But the problem is people had no choice. Their manufacturing was all out of China. They still had customers that wanted stuff, and actually during the initial stages, the demand was really there as well. So, it meant that they carried on, they paid these extortionate fees. Shipping lines were happy taking the money. But now it's calmed down a bit. People are sitting back taking notice. McKinsey & Company recently did a survey, speaking to business leaders, and 93% of them now one to increase resilience within their supply chain. They don't want that kind of risk again. So, it's something people are looking at. The question now is whether they take the plunge?

You know, it's not just Covid either. There are other issues. As everyone knows, we don't have a great relationship with China, as most Western countries probably fall into that category. I know Rishi Sunak, doesn't appear to be a big fan. He's claimed the golden era of our relations with China are pretty much over. So that, you know, that's not positive to talk about how things might go in the future. The other thing as well not I've mentioned, the actual cost of manufacturing is increasing in China which was inevitable over the years because for the people living in China, the wages have gone up a lot. Even though manufacturing locations have moved to cheaper locations over the years, many going further north and then possibly looking further inland in China. Despite that, it’s certainly another impact.

Scott Wallis

Yeah. I suppose it's to be expected then that business leaders don't really want to be exposed to that kind of cost increase again. You spoke early in that answer about freight rates increasing to extraordinary levels. So, I suppose it’s understandable and the business leaders are thinking about ways around that, and you've touched on quite a lot of the concerns there. But it's undoubtable that China remains an extremely big import partner of the UK's.

Justin Hope

Absolutely. I mean, it's the biggest import partner we have and no signs of that changing in the near future. In 2021 we imported £63bn worth of goods. That's even more than from Germany who are almost on our doorstep by comparison. So, it shows how valuable the manufacturing in China is and how important it is to the UK. So, if there are to be any changes, it's going to be quite a long, slow process, I'd imagine. From WTA's perspective, my focus is on imports, and I'd say probably 75% of what we import would be from China. So, it's just massive that's why it would be a big step and it's a big decision, but it's something that people are and will have to carry on looking at.

Scott Wallis

Yeah. Obviously, it's only one logistics provider, you know, ourselves, WTA, but it's interesting context. There's obviously no science in those figures, but as a rough estimate, a very huge percentage of our shipments from Asia are coming out of China. Now I suppose this next question, will be well known to people that have been importing for a long time. But I just I just thought, it might be worth getting perhaps a 2023 take on this question. Why is China still so strong as an import partner? In 2023 what does it still have going for it?

Justin Hope

We're still looking at the same sort of things really. I mean, the most obvious one is the price. Given the choice, I'm sure companies in the UK would manufacture in the UK if they could do it for the same cost. The actual cost of manufacturing, even with the increased labour cost, even with freight rates is still cheaper. I mean, it's still probably 30 to 40% cheaper to import from China than, for example, manufacturing in the UK. Of course, that depends on what the product is. There are some products where we may be slightly more competitive. But in general, we're, you know, we're talking big differences and that's why what businesses continue doing it.

Also, the infrastructure is in place as well. They've got very good infrastructure in China in terms of their own logistics internally, because of the volumes and how it's evolved over the years. The shipping lines have geared themselves towards that, knowing that that's where the main volumes are coming out of and that's why the vessels have been getting bigger and bigger over the years because they want to carry as many containers as they can on to each vessel to bring their own cost down. So of course, the main China ports are where all their biggest vessels call, and therefore, their regular sailings. Generally, you're looking at, at least weekly sailings from each shipping line out of all the main China ports.

One of the other things as well which can get overlooked is how the Chinese government sort of deliberately set their currency low against the dollar in an effort to boost their exports.

Scott Wallis

Yeah. It's certainly true. I believe it did used to be pegged directly against the dollar and it they used that to fix it. I think now it floats a little bit, but they still keep it effectively at a low level, so it makes their exports more competitive.

Justin Hope

No, and that's been part of their success, their ability to do that.

Scott Wallis

Yeah, absolutely. Well, we do have a lot more on the strengths of the China market for business imports. In our whitepaper, which you can download from the show notes of this podcast.

But, you know, we're going focus more on the concerns now, because that is what we're talking about today. So, one of those concerns that we spoke about earlier is a drive for building a bit more resilience into a supply chain. What other indicators are out there, for business leaders, that can maybe help them choose a new location for their imports? What are some online things that they can they can look at to help make that decision?

Justin Hope

Yeah. Well, there's a couple of things. There's the World Bank, they publish a Logistics Performance Indicator, and they rank every country in the world on key aspects of logistics. So that would be a good start point. A couple of countries, Thailand, Vietnam, they actually score as well as China on that. So, we've just talked about how well set up China are, but Thailand and Vietnam, are their equals in that respect. The World Bank also has another index called Ease of Doing business, which is pretty self-explanatory. Again, Thailand actually rank above China on there, as do Malaysia. So, again, there's a couple of things there that I'm sure if you do a Google, you should find the full list if there are specific countries that you’re looking at. courses UK and embassies for each of those countries.

Of course, there’s UK embassies for each of those countries, which would have their own commercial departments and are more than happy to assist with sourcing potential suppliers for your products in that nation.

You need to look at the relationship between UK and whichever country you're considering because depending on your reasons for relocating your manufacturing, if one of your concerns was, for example, the relationship we've got with China at the moment and your concern that it's deteriorating, it would be pointless then looking at another country where we don't have a great relationship.

I guess something else people might not be aware of, I wasn’t until we looked more closely at it, that UK and Vietnam have actually had a free trade deal since the start of 2021. So clearly, they could in time become a viable option because there will be benefits to that.

For importers, another factor of course, and this is becoming a hotter topic as every year passes, is the ESG impacts. Research last year suggested that 3/4s of the British public are concerned by climate change, and if that's what people are thinking, then businesses need to consider that as well. It’s not something you can just say, ‘oh, we don't care as long as we get our stuff in cheap, that's all we’re bothered about’, it’s something that in time, and I think as the younger generation start coming through, we're even more conscious and aware of. It will become a big factor. So, it is certainly something that needs to be considered.

Scott Wallis

Yeah, it does feel as though it's increasingly driving purchasing decisions. I suppose there's logistical elements to that as well, perhaps bringing more sea freight into the mix. As an importer could perhaps opt for that rather than changing import location. You could look at various different aspects of your supply chain and to address that point.

But sticking with the relocating parts of your supply chain or looking at other options as is the topic of the podcast, we'll look at some other obvious nations in that region then. I think we'll start with India because that feels as though it's an obvious choice, and the reason I say that I suppose is because it's comparable in terms of population to China. What's your experience with India? Does that look like a reasonable option for shippers to perhaps explore on paper? All the paper talk would suggest it's the next economy that's going to have sort of extreme growth over the next 10 years.

Justin Hope

I think we're already sort of seeing it. We move a fair percentage from India, though nothing like what we import from China. Yes, they are growing rapidly. I think on average, it's like 5-10% GDP growth year-on-year. So, compared to some countries, that's pretty significant, and of the main emerging countries, it's expected to have the largest growth this year.

But when I speak to importers about what we're discussing here really, I think one of the biggest concerns that people have is the infrastructure on the logistics side of things. There are some other issues with regards to communication and service and sometimes quality of the products.

But on the shipping logistics side of things, with the size of India, whereas in China, most of the manufacturing is sort of near the ports, a lot of the manufacture in India is a bit more inland. So you might have to use the rail network, which is notoriously unreliable.

There aren’t such good options for port calls, although that has certainly improved over the years. It's not in the same league as China. They're definitely things that people have discussed as concerns. But I think it will improve over the years. I believe they're very committed, the Indian government, to taking advantage of what we're discussing here, the potential opportunity there. So, I think it will become more prevalent as we go forward.

For the UK, of course, post-Brexit trade deals, we're currently talking with India. I think we’re on the seventh round of talks at the moment. I don’t know if that's a good or a bad sign as to how things are going. But once they do come to a deal, that's clearly going to increase the trade we do with India. Think it's expected to increase by about 30% by 2035 once the deal is finally signed and similarly to the Vietnam one, clearly it’s going to make India more attractive if we can overcome the logistical issues.

Scott Wallis

Yeah. Seventh round of talks. Someone's very keen. They're trying very hard, aren't they?

Justin Hope

They are driving a hard bargain.

Scott Wallis

Interesting to see how that one develops. But, yes, I suppose it is a good sign and you have to say the relationship between the UK and India is seems fairly strong.

Now you mentioned Vietnam at the end of your answer, so we'll move on to them. We've already talked about how there is a free trade deal already in place for Vietnam, which may have passed people by. I certainly wasn't aware of it until I was researching for this podcast. How viable would you say Vietnam is an option?

Justin Hope

In terms of viability, they're increasing quite nicely in terms of their Ease of Doing business ranking. They're up to seventieth, which doesn’t sound great, but is up 34 places. So, it’s moving in the right direction. They're keen. The government have got very much a pro-business agenda. They're keen to do more international trade. They've likely seen this whole China Plus One thing, which we’ll come on to shortly, and seen a potential opportunity there.

The logistics infrastructure is improving, in terms of more vessels calling into their main port, so that's again making it slightly more viable. For importers wanting to consider manufacturing there, with this free trade deal which we've talked about, by 2027 pretty much all imports from Vietnam will have tariffs removed. I think it's something like 99.2%. So that covers pretty much everything.

Scott Wallis

Yeah, it's a good chance your products will be in that.

Justin Hope

You'd be a bit gutted if you're the 0.8%. But, what can you do?

Scott Wallis

Ha-ha, yeah. Okay. So, Vietnam is looking like an increasingly attractive option then for importers. Just finally then we'll focus on another one of the obvious ones. That's Thailand. They have been mentioned a couple of times already. From my kind of untrained perspective, they feel like one of the more developed countries in the region.

Justin Hope

Yeah. You're right. But their growth figures don't compare to the likes of China and India. I mean their growth over the last 10 years has only been sort of 2–4%. One of the other issues is there's no activity towards a free trade deal with them at the moment. So, in terms of Thailand - UK as an option, then potentially others will become more favourable, as we've mentioned Vietnam, India, if we did get a deal in place with them. At least the discussions are ongoing even if we are even if they are dragging on a bit at the moment. We’re not really in any discussions with Thailand.

They are actually ranked higher than China in terms of the Ease of Doing business, though, and they're 21st, and as I said earlier, I think Vietnam are 70th. So they're quite high up there.

Infrastructure is improving as well. Some big developments going on at Laem Chabang, which is just round the corner from Bangkok. A lot of the large shipping lines use that as their main port rather than rather than Bangkok, and they're looking at expanding that to 18m TEU by 2025. So, they are trying to put the infrastructure in place. Again, all of these countries in that area must be looking at China and thinking at some point there could be an opportunity here.

Scott Wallis

Yeah, and we do talk a lot more about the options available for businesses importing in the whitepaper, which we've already referenced. It's in the show notes of the podcast. Malaysia is discussed in there. So is Eastern Europe, which is also an option, perhaps moving away from Asia completely and nearshoring your supply chain. It's all covered in the whitepaper.

But another concept I'd like to talk about with you, if that's alright, is this China Plus One mentality. It's a bit of a supply chain buzzword at the moment. Its name is quite self-explanatory, but for someone that's perhaps not exactly sure what it means. Could you just explain the China Plus One approach?

Justin Hope

Yeah. I mean, this this this phrase has been sort of knocking around for, I don't know, 10 years or so now. Guess more as a concept than something that a lot of people have actually been actively looking at. But for the reasons we've discussed since the start of this, I think it's something that's being even more closely looked at now. Really, it's a case of avoiding putting all your eggs in one basket, where if you just use factories and manufacturers in China, what happens if something goes wrong? Do you leave yourself exposed? Is it a risk?

I mentioned earlier that I've spoken to customers that have already been looking at this 10 years or so ago. Not even necessarily just alternative Asian markets, but also, as you've just touched on, Eastern Europe, considering that as an alternative. Not even just for the reasons we discussed, but if there is an issue, you know, with a particular factory, then do you have an alternative? If you do, why make it another factory in China? Why not somewhere else in Asia? So, it's something that people are beginning to look at. I mean, take one of the biggest players out there, Apple, their iPhone 13, that's going to be manufactured in India. So I mean, for India, they were clearly a massive boost. Now because Apple and iPhones and their margins, they can actually afford to air freight all of their phones. So they don't necessarily have to worry so much about the infrastructure issues. But it's clearly a sign that they've considered this. They don't want to pull their eggs in one basket.

India is saying they're well positioned to become a partner under China Plus One. They call it that themselves, and they're hopeful of becoming part of this global supply chain as a not necessarily a backup, but as or an alternative, but to supplement the requirements for electronic products, chipsets, semiconductors and so on. So it's happening, if Apple are doing it, then boy shouldn't other companies be considering it. So India could do well out of this, and I think they're sort of gearing themselves for that. Other countries that it could benefit would be the likes of Mexico, the EU we've touched on. Even Vietnam, they could all benefit from this approach.

Scott Wallis

Yeah. I was reading today actually that I think Apple plan ultimately to have 25% of their manufacturing done in India. I think at the moment, it's maybe 7-8% and they're trying to work that to about 20-25%. So, it does show as you mentioned, a real kind of world-famous company rolling out this strategy. In your supply chain logistics experience then do you think it as a strategy would work? Do you think, had more companies had this kind of China plus one approach, they would have avoided a lot of the logistics option of the of the last few years? And it would have stood them in good stead?

Justin Hope

I think if it was it had been established prior to the Covid disruptions, then certainly would have been a benefit. A lot of it would also depend on how that split is. For example, if you've got someone manufacturing Product A in China, but Product B in Vietnam, then you know, you may not see the benefit. It's almost like you've got to have factories in more in one location, manufacturing the same product, and that will take time.

Clearly, it's not viable for every product. Because not every country can manufacture the same standard and the pricing might not be right. But it's certainly something that companies should and indeed are considering already, and if there is another Covid in 10 years' time, then I imagine quite a lot of companies and businesses will have something in place to be able to deal with that a bit better than anyone did.

Scott Wallis

Yeah. I suppose it's just about keeping options open and you're quite right for some it's very unique to business circumstances in many ways. There's lots of products that that it just wouldn't it wouldn't necessarily work for. But, you know, lots of food for thought for supply chain managers. We know it's a question that a lot of them are asking.

Just lastly then the multimillion-dollar question that I'm going to ask you is whether you whether you can foresee a sort of, en-masse moving of supply chains away from China, or is China still just too good?

Justin Hope

Well, this is just my opinion. Can't see an en-masse movement away from China for now. For the reasons we've discussed, it's still got the best set up. It's still got the best pricing. It's still a great option for businesses, which is why people still use China despite the issues we've discussed. So in terms of affordability, being able to bring products to the UK and sell them and be profitable and give customers the benefit of those lower prices. I can't see an en-masse moving away from it, but I do think that people will be looking more at alternatives, backups, having more than one sourcing location in place. Because the impact of what happened during the pandemic has to be addressed.

If we have another one in 10 years' time and nobody's done anything different, they're all going to have same problems again. I don't I don't think anyone wants to go through that again. So, if it's in any way, profitable for their product, then I think it's certainly something that people look at, and actually, since the whitepaper went out only a week ago, two customers have both said it's something they're very seriously looking at already. So, they did find the whitepaper useful. It almost like reinforces what they're thinking, and with what Apple have done, it's showing it's not necessarily just talk, it’s actually happening.

Scott Wallis

And I suppose right at the very top of the people that don't want to go through that again, is probably you.

Justin Hope

Ha-ha, no. It's great fun! Been a cracking 18 months, two years. Delivering bad news every day.

Scott Wallis

Yeah. Just spending all every day, apologising.

Justin Hope

Ha-ha, yeah. On behalf of shipping lines.

Scott Wallis

Yeah. Well, thanks very much for joining me Justin. That was that was very interesting insight. Cheers.

Justin Hope

Okay. You're welcome.