On April 25th 2024, the EU’s Consortia Block Exemption Regulation (CBER) expired, along with the UK’s equivalent legislation. This is a law, introduced in 2009, to protect the shipping lines such as Maersk, CMA CGM and MSC, from being subject to certain anti-competition laws, as part of the EU internal market.

Basically, it meant shipping lines could cooperate without being subject to the same strict laws other firms would be, on service loops which docked at one or more EU and UK port. However, for its application, certain conditions needed to be met:

- Any cooperation could not contain hardcore restrictions, such as price fixing, capacity or sales limitations (except for capacity adjustments to reflect changes in demand).

- Market share of any cooperation could not exceed 30%.

- A cooperation must give members the right to withdraw with a maximum period of 6 months’ notice.

But it’s a law now deemed unfit for purpose, so surely its expiry will be a significant development for goods businesses?

Well here we will answer all the important questions about the CBER and crucially, what it’s expiry mean for businesses moving goods internationally in the UK and EU.

Why was the CBER introduced?

The introduction of the CBER meant shipping lines could cooperate on things like vessel sharing and offering joint cargo transport services.

Consequently, it was believed that this would lead to greater economies of scale and better utilisation of space on vessels, which was a more favourable shipping environment for shippers within the EU and UK. It would also reduce the costs for the carriers, so in theory, everybody wins.

Why does its expiry still impact the UK, despite Brexit?

When the UK officially left the European Union in 2021, the Competition and Markets Authority in the UK carried over the Liner Shipping Consortia Block Exemption Regulation for Great Britain and Northern Ireland.

However, in February 2024, it was announced that the UK CMA would not be recommending the regulation be renewed in any form. Therefore, it too expired on April 25th.

Why is the CBER being left to expire?

It will come as no surprise to shippers that this piece of regulation has been deemed unfit for purpose.

After the supply chain crunch between 2020 and 2023, the CBER proved to be woefully inadequate for protecting businesses from surging costs and it certainly didn’t benefit all supply chain stakeholders.

The EU state in their research with industry stakeholders, there was desire for greater regulation of the sector, not administrative simplification. Hence their and the UK’s decision to allow expiry of the regulation.

“Since the CBER was adopted in 2009, market developments in the liner shipping sector have shown that a dedicated block exemption regulation is no longer fit for purpose."

"Overall, the evidence collected from the relevant stakeholders and market participants points towards the low or limited effectiveness and efficiency of the CBER throughout the 2020-2023 period.”

It was also noted that given the conditions of the regulation, it only brought limited compliance cost savings for shipping lines and wasn’t a big factor in carriers’ decisions to enter cooperation.

So, does this mean shipping lines can no longer cooperate?

In a word, no. It doesn't.

Those involved in shipping are all too familiar with the big shipping line alliances. The 2M alliance between Maersk and MSC is a cooperation that is due to expire in January 2025, but Maersk will be joining straight into a Gemini Cooperation with Hapag-Lloyd.

Until then Hapag-Lloyd themselves are part of THE Alliance, with ONE, HMM, and Yang Ming. An alliance that will continue despite divorce with Hapag-Lloyd.

Meanwhile, OOCL, CMA-CGM Cosco, and Evergreen make up the Ocean Alliance, now the largest cooperation, boasting a 37.2% market share on Asia-Europe routes.

These alliances aren’t going to be impacted by the CBER expiry, as many of them fall outside the scope of the regulation anyway. For agreements between carriers that do fall within its scope, it just means they will have to self-assess whether their cooperation meets the anti-competition laws (Article 101 TFEU ) that other businesses are subject to.

Shipping lines must use the detailed Horizontal Guidelines and Specialist Block Exemption Regulation guidance to reach their conclusions independently.

What does expiry of the CBER mean for businesses?

It’s fair to say the decision to allow the CBER to expire has been well received by shippers in the UK and EU. The supply chain crunch between 2020 and 2023 left many understandably very angry about the profiteering that took place.

Many industry stakeholders would say cooperation between shipping lines has always been only beneficial to them. A position which was amplified by the events of Covid-19.

With reduced cooperation between shipping lines operating in the UK and EU, the obvious impact is increased competition between carriers. That could drive prices further down for shippers, as in any competitive market.

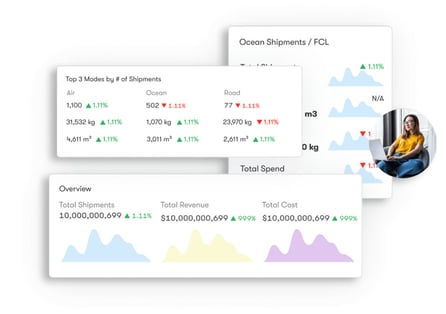

We could also see increasing innovation from the lines, looking to compete on other selling points beyond price. This could take so many forms. We’re seeing an abundance of logistics technology flood the market from stakeholders, such as our WTA Platform. We’re now able to offer real-time visibility and endless data points related to your supply chain, allowing you to make informed optimisations, not best guesses.

Technology advancements like that could become more of a key battleground for the carriers.

We might see the lines compete on service reliability. Something the incoming Gemini Cooperation is promising over 90% on. Or perhaps improvements in their communication with customers, which is famously lacking throughout the industry.

All of these would be welcome developments for businesses trading internationally.

However, the expiry of the CBER does pose some threats to shippers. Less efficient operations could mean an increase in prices for shippers as space on vessels isn’t utilised as effectively.

There could be fewer services offered, or more awkward scheduling on service loops, with lines unable to sync them up to serve customers better.

The full impact of the CBER and UK equivalent expiring remains a relative unknown for the industry. We know it won’t lead to the demise of cooperation between shipping lines, they will just have to self-regulate and be more careful about how they work together.

Could we see an increasing number of shippers suing the lines they feel are in breach of competition laws? Could we see the EU and others bringing in increased regulation of the industry, as they have hinted in communications?

Whatever the next steps for the industry, the best action for any shipper is to remain informed. Subscribe to our Market Update to receive weekly logistics industry news and freight rate forecasts straight to your inbox. Whether it's an unexpected crisis like the ongoing Red Sea issues, or legislation changes, you’ll never miss a development.